Income calculation in us mortgage

Their income is determined by profit-and-loss statements 1099s and tax returns. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You.

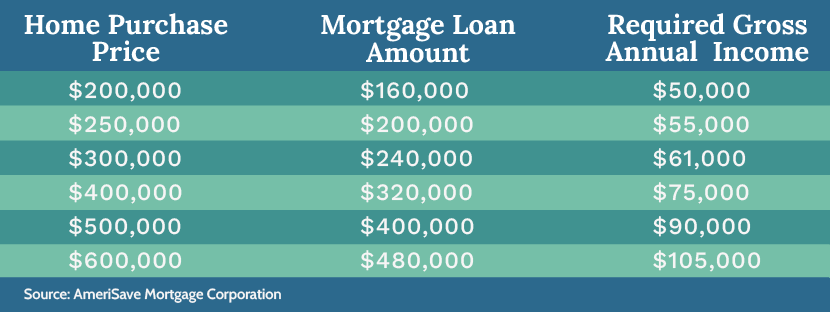

Income Requirements Calculator For A Home Mortgage Amerisave

In the event if you are an employee who is on salary this is the way you calculate your monthly income for mortgage calculation.

. DTI is always calculated on a monthly basis. If you have a salary of 72000 per year then your usable income for purposes of calculating DTI is 6000 per month. Ad Our Mortgage Payment Calculator Can Help Estimate Your Monthly Mortgage Payments.

In most financial situations net cash flow is represented by subtracting your expenses from your income. Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment. Our Online Application Allows For Electronic Signatures Sharing Of Documents And More.

This debt to income calculator will assist you in estimating your monthly income for mortgage preapproval and determining the debt to income ratio. Fortunately that wont exclude you from getting a mortgage. When it comes to calculating affordability your income debts and down payment are primary factors.

Please contact us at Gustan Cho Associates. INCOME CALCULATION WORKSHEET PART I - INCOME TYPE Section Borrower Co-Borrower 1 Hourly. For more information or to apply for a mortgage please contact us on 1300 889 743 or complete our today.

Factors that impact affordability. Calculating Income 16 Effective for applications taken April 14 through June 31 2020 Age of Documents For most income and asset documents age requirements is reduced from four. Find the Housing Loan You Need.

Find your net income from Schedule C on your tax returns for the two most. The calculator works immediately as you slide or input your gross monthly income monthly debts loan terms interest rate and down payment. Ad Knowing How Much You Can Afford Is The First Step Towards Homeownership.

Viable debt sources include. Its possible to get approved with. 9500 Total income across three years 25000 Divide this 25000 by the number of months for which youve collected income.

Ad Competitive RatesFees Online Conveniences - Start To Apply Today. This calculation compares your monthly gross income typically from the income sources above to your monthly debt load. 2021 6 months 2020 12.

In Scenario 1a lenders take your Net. A debt-to-income ratio is the percentage of gross monthly income that goes toward paying debts and is used by lenders to measure your ability to manage. Scroll down the page for more detailed guidance.

To calculate your self-employment income for a mortgage application follow these simple steps. See Part II Section 2. Lender Mortgage Rates Have Been At Historic Lows.

Determine Your Monthly Mortgage Budget By Using Our Home Affordability Calculator Today. Explore Quotes From Top Lenders All In One Place. Take Advantage And Lock In A Great Rate.

An underwriter will calculate your income by taking your current yearly salary and breaking it down to a per-month basis. How much house you can afford is also dependent on. Our Online Application Allows For Electronic Signatures Sharing Of Documents And More.

The first step to prequalify for a. Beyond being time-tested the. To calculate income for a self-employed borrower mortgage lenders will typically add the adjusted gross income as shown on the two most recent years federal tax returns.

They calculate your income by adding it up and dividing by 24 months. What is a debt-to-income ratio. Becoming the mortgage industrys income source has been the result of thousands of customer conversations programmatic iterations and sleepless nights.

Monthly minimum credit card. Now you are ready to. Ad Competitive RatesFees Online Conveniences - Start To Apply Today.

You will need to provide your most recent pay stub and IRS W-2 forms. However in rental scenarios its a bit more complicated. For example say year one the business income is 80000 and year two 83000.

See Part II Section 1a 1b 1c or 1d seasonal worker 2 Weekly.

How To Calculate Income Calculating Income Mortgage Math Nmls Test Tips Youtube

Schedule C Income Mortgagemark Com

How A Mortgage Underwriter Calculates A Homebuyer S Income In Plain English

Your Mortgage Should Not Exceed 2 5x Gross Income By Pendora The Startup Medium

2

How To Calculate Debt To Income Ratio

Calculating Income For Mortgages With Schedule C Or C Ez Youtube

What Is Debt To Income Ratio Dti And Why Does It Matter Nextadvisor With Time

:max_bytes(150000):strip_icc()/dotdash_INV_final_Qualifying_Ratios_Jan_2021-01-33089daf17f749d8b71dfec13e9415cf.jpg)

Qualifying Ratios Definition

Here Are The Income Requirements For A Reverse Mortgage

Self Employment Income Mortgagemark Com

How Income Is Calculate For A Mortgage Self Employed Fixed Income Rental Income W2 Youtube

How To Calculate Your Debt To Income Ratio Lendingtree

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Debt To Income Ratio Formula Calculator Excel Template

3 Fatal Income Calculation Mistakes And How To Avoid Them Find My Way Home

Self Employment Income Mortgagemark Com